Image

By Malorie Larson, Shoreline, WA

Levies and taxes can be confusing, especially when costs keep rising. I understand why voters want to know how a levy will actually affect their household budget. Here’s how I calculated the real cost for my family before deciding how to vote on the Shoreline School District EP&O and Technology Levies on the February 10, 2026, ballot.

Step 1: Enter your address here on the county assessor’s website to find your assessed property value.

Step 2: Scroll to your tax history and note the “Taxable Total” for each year. Look at how that number has changed over time.

Step 3: Divide “Taxable Total” by 1,000, then multiply by the corresponding levy rate for that year. This shows how much you’ve already paid to the school district for that year.

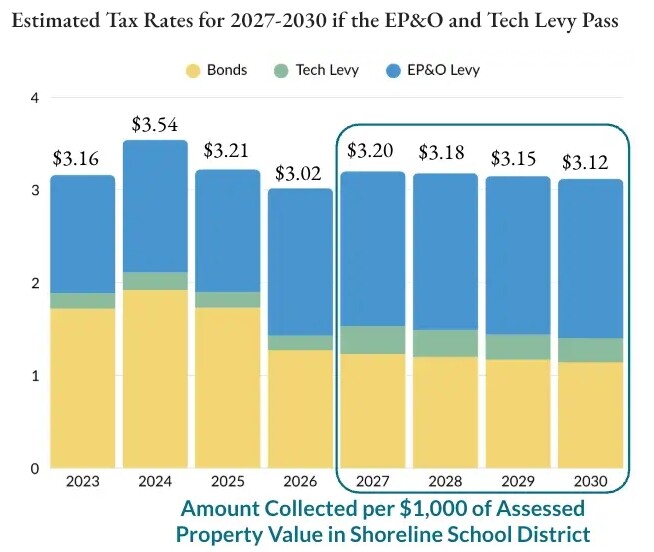

Use this district chart to find the levy rate for each year:

Future property values are unknown, so estimates matter. In my case, my assessed value has gone up by 7.5% in one year and down by 14% in another. Remember, we are not voting on property values; those are outside our control.

If my property value stays the same (I don’t expect it to, but I’m using this to estimate my future expenses), the replacement EP&O and Tech levies would cost my household an additional $157.37 per year from 2027–2030. Claims that homeowners will pay “thousands more” are misleading. Compare what you paid from 2023–2026 to what you may pay from 2027–2030. The current average levy rate is $3.23 per $1,000 of assessed property value, while the proposed replacement average rate is $3.16.

Personally, I’m willing to pay an additional $200 per year to support smaller class sizes, student supports, extracurriculars, and updated technology for Shoreline and Lake Forest Park students. My goal is simply to help families understand the real-world costs before voting.