Image

Shoreline, WA — Shoreline School District voters will see two replacement levy propositions on the February 10, 2026, ballot: a replacement Educational Programs and Operations (EP&O) Levy and a replacement Capital Levy for Technology.

If approved by voters, the replacement levies would take effect in January 2027 and would not overlap with the current levies.

The EP&O levy and the technology levy will appear as two separate

ballot propositions, allowing voters to vote on each independently.

Levies require a simple majority (50% plus one) to pass.

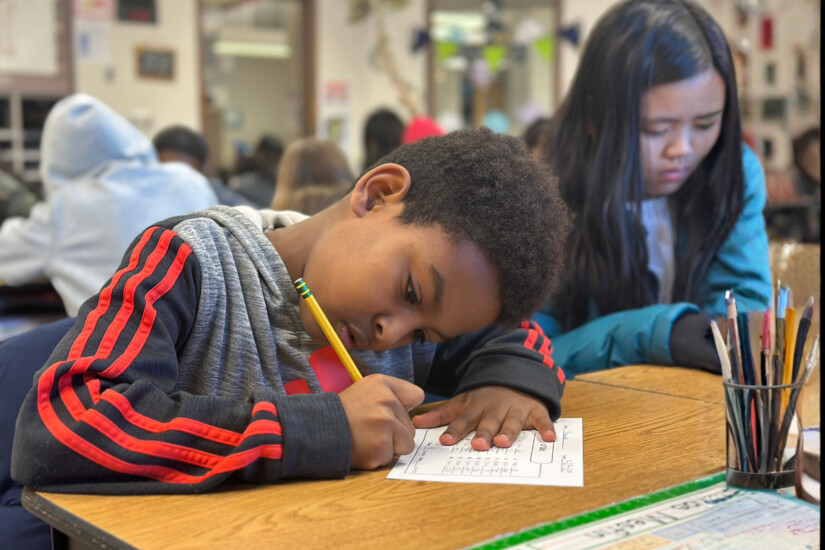

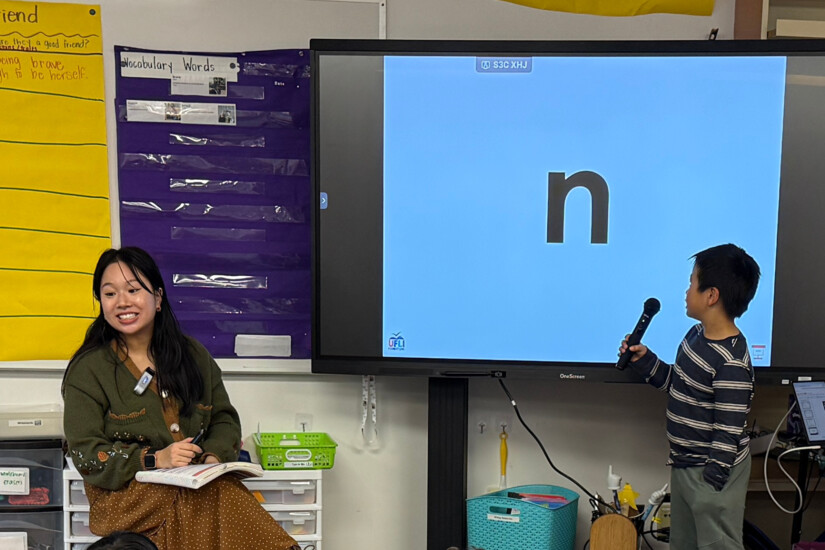

EP&O replacement levy funding supports school programs and services that are not fully funded by the state of Washington. These include staffing to

maintain class sizes, professional development, multilingual learner

programs, inclusive learning supports, school-based student support

staff, transportation, athletics, performing arts, and extracurricular

activities. The current EP&O levy provides approximately 16.5% of

the district’s General Fund operating revenue.

The proposed EP&O levy would collect between $39 million and $46.5

million annually over four years, with tax rates estimated between $1.67

and $1.72 per $1,000 of assessed property value, depending on year and

assessed valuation growth.

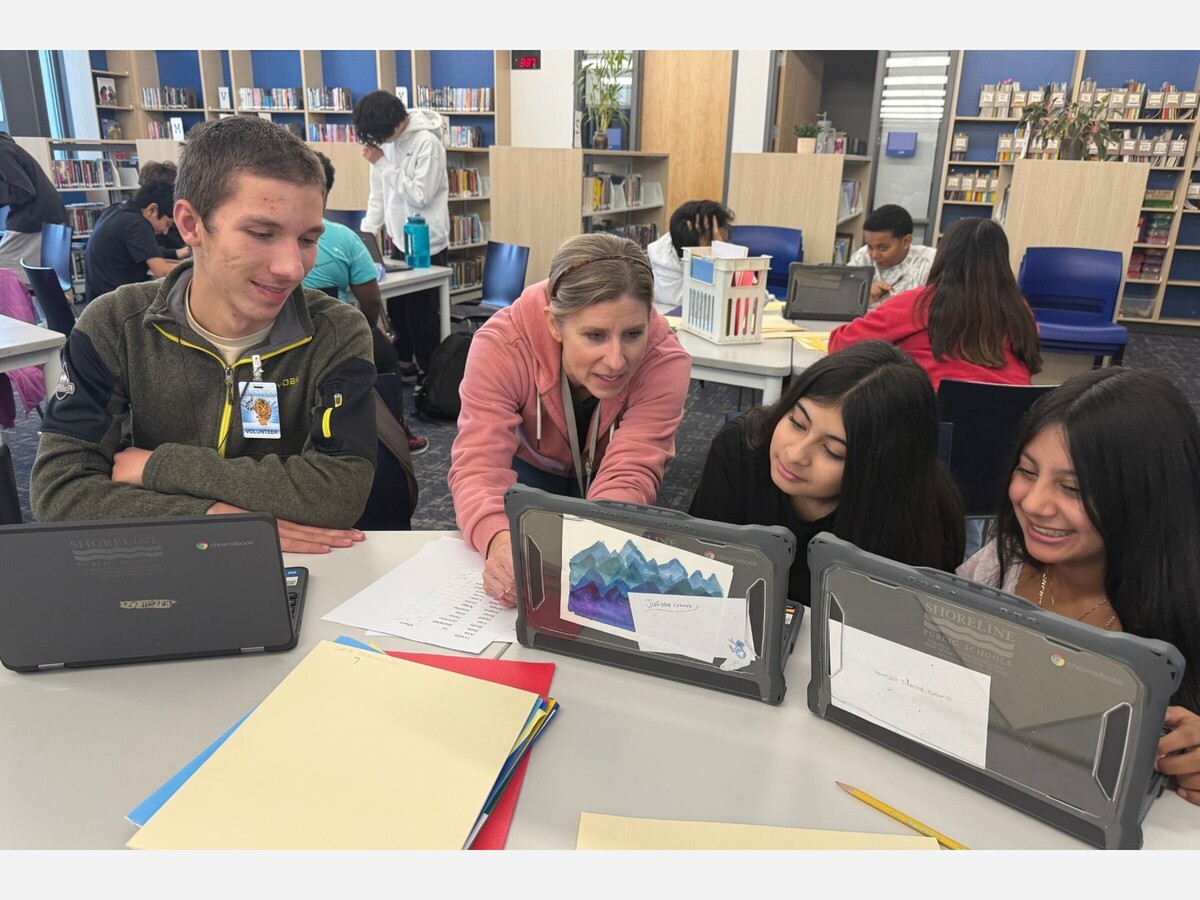

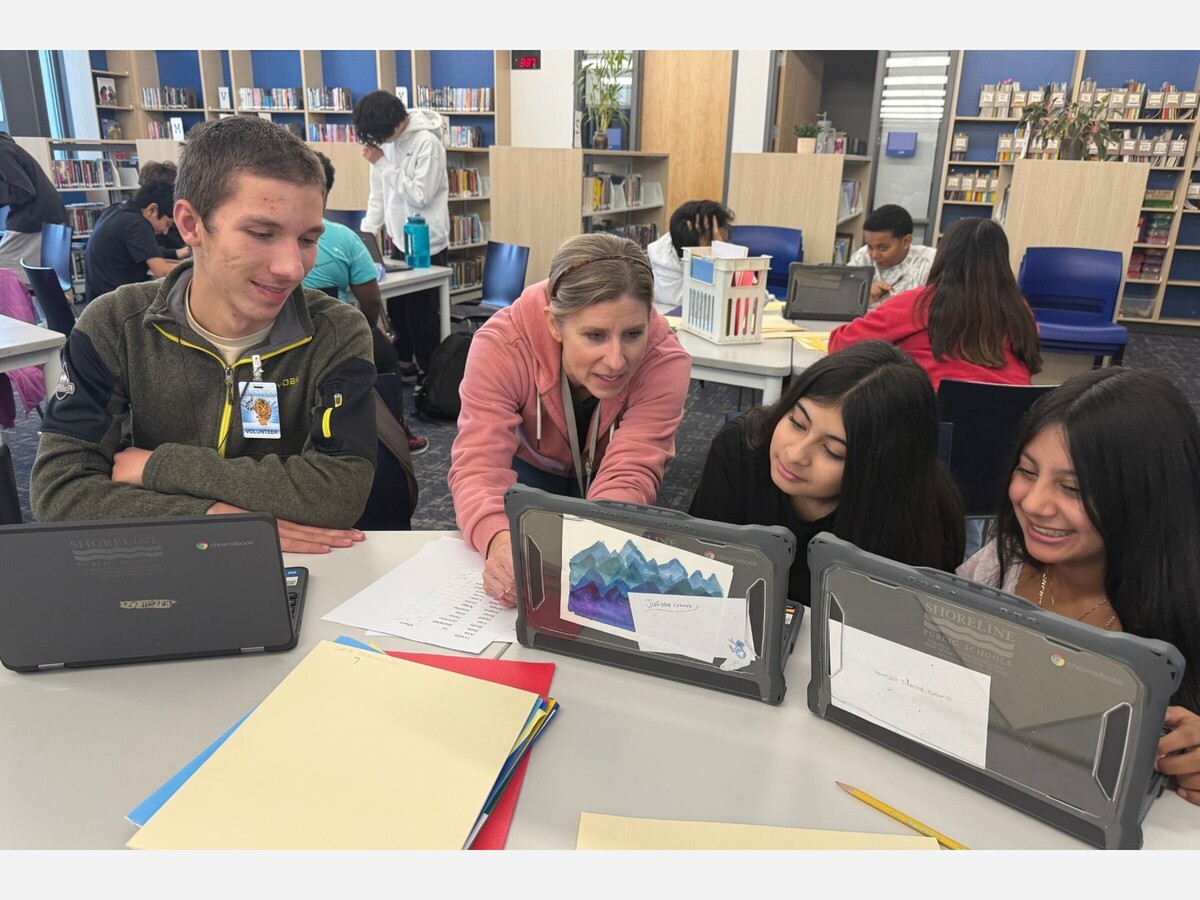

The proposed replacement tech levy would fund maintenance and replacement

of student and staff devices, network infrastructure and cybersecurity,

classroom technology, digital curriculum and assessment systems, and

districtwide technology support and training. These are considered

capital investments and are separate from operational costs funded by

the EP&O levy.

The technology levy would collect $7 million annually from 2027–2030, with

estimated tax rates ranging from $0.30 to $0.26 per $1,000 of assessed

value over the life of the levy.

Both measures are designed to replace existing levies that expire at the end of 2026, with collections proposed for 2027–2030.

Washington State funding has not kept pace with rising operating costs or the

academic, social, and behavioral services our students require. Since

2021, Shoreline School District estimates that insufficient state

funding has resulted in a cumulative gap of approximately $136 million,

including shortfalls in salaries and benefits, special education,

utilities, and insurance.

Owners of property in Shoreline School District contribute to local education

funding with a portion of their property taxes. This funding for local

schools goes toward both bonds and levies.

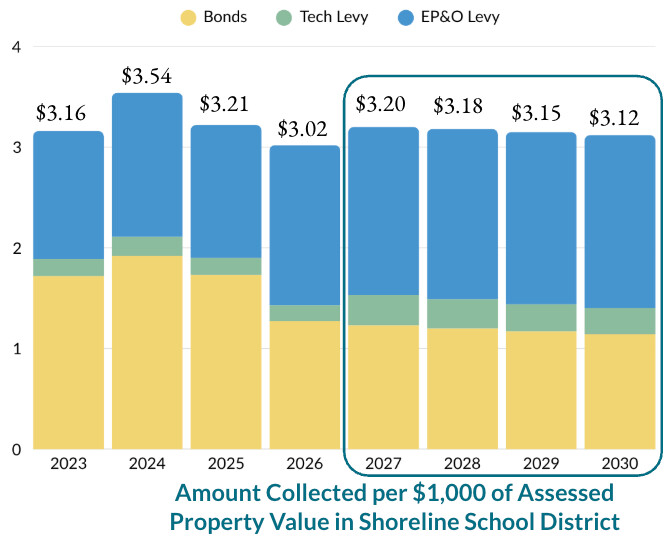

This graph illustrates the total local school taxes collected per $1,000 of

assessed property value from 2023 through 2030. The total includes bond

repayments, the tech levy and the EP&O levy, including current and

proposed amounts.

Tax rates peaked in 2024, followed by decreases in 2025 and 2026 (even with

the one-year supplemental levy approved in August). The projected tax

rates shown for 2027–2030 reflect estimates if the proposed replacement

EP&O and technology levies are approved by voters in February.

Ballots will be mailed beginning January 21, 2026. Election Day is February 10,

2026, and ballots must be postmarked or returned to a ballot drop box

by 8:00 p.m. that day.

Shoreline School District Superintendent Susana Reyes will host community forums in January and February to share information and answer questions about the replacement levies:

Monday, Jan. 26

5:00 - 6:00 pm

Thursday, Jan. 29

Noon - 1:00 pm

Wednesday, Feb. 4

7:00 - 8:00 pm

Zoom links and more information about the levies are available at ssd412.org/Levies26.